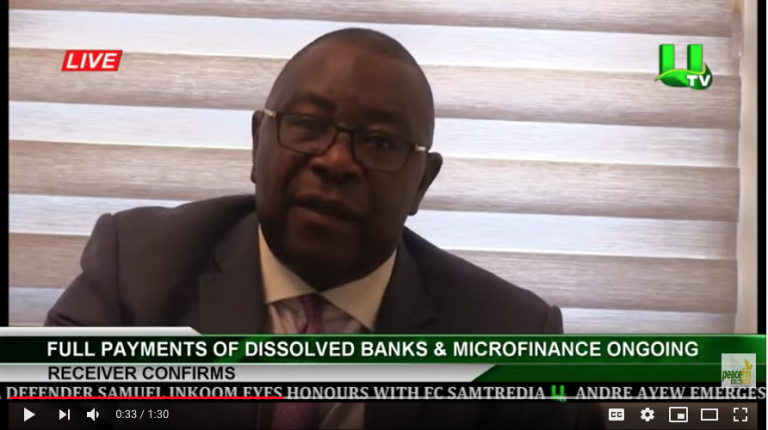

As at close of today, February 27, 2020, a total of 8,884 customers of the collapsed savings and loans (MS&Ls), Micro Finance Institutions (MFIs) and Micro-credit Institutions have been paid their monies, Consolidated Bank of Ghana has announced. For Savings and Loans, 449 social organisations, 418 companies and 152 rural banks and finance houses have been paid. 132 social organisations, 22 rural banks and finance houses, 48 financial security entities and 44 companies have so far received their locked-up funds with regard to MFIs. Under Micro-Credit Institutions, 28 companies and institutions have so far been paid their monies. The Bank of Ghana appointed Director of Price Waterhouse Coopers Limited, Eric Nana Nipah, as the Receiver in accordance with Section 123 of ACT 930 of Bank of Ghana (BoG). Eric Nana Nipah, however, noted that a combination of cash and bond will be used to settle depositors. Meanwhile, he averred he is hopeful that with the above funding arrangement, about 97.6% of individual claimants will receive their entire deposits in cash. https://www.youtube.com/watch?v=lrNsNRK7qW8